For Event Organizers

Bring effortless lead capture to every booth.

Zero friction for attendees. More leads for exhibitors. Complete visibility for organizers.

The Problem

Lead capture at events is still broken

Attendees face "form fatigue," re-entering the same information at every booth. Long lines cause them to skip booths entirely.

Exhibitors generate fewer leads and deal with messy, inconsistent data they can't use.

You are left without booth-level analytics, making it impossible to prove event ROI or justify sponsor pricing.

How It Works

Tap. Confirm. Done.

Attendee taps

Every booth gets a tag. Attendees tap their phone—no app download required.

Pre-filled form

Info auto-fills from their profile. They confirm and submit in seconds. New fields are a quick type-in.

Leads flow instantly

Exhibitors get clean, export-ready leads. You get booth-level engagement analytics across every exhibitor.

For Organizers

Finally, visibility into what's happening at every booth

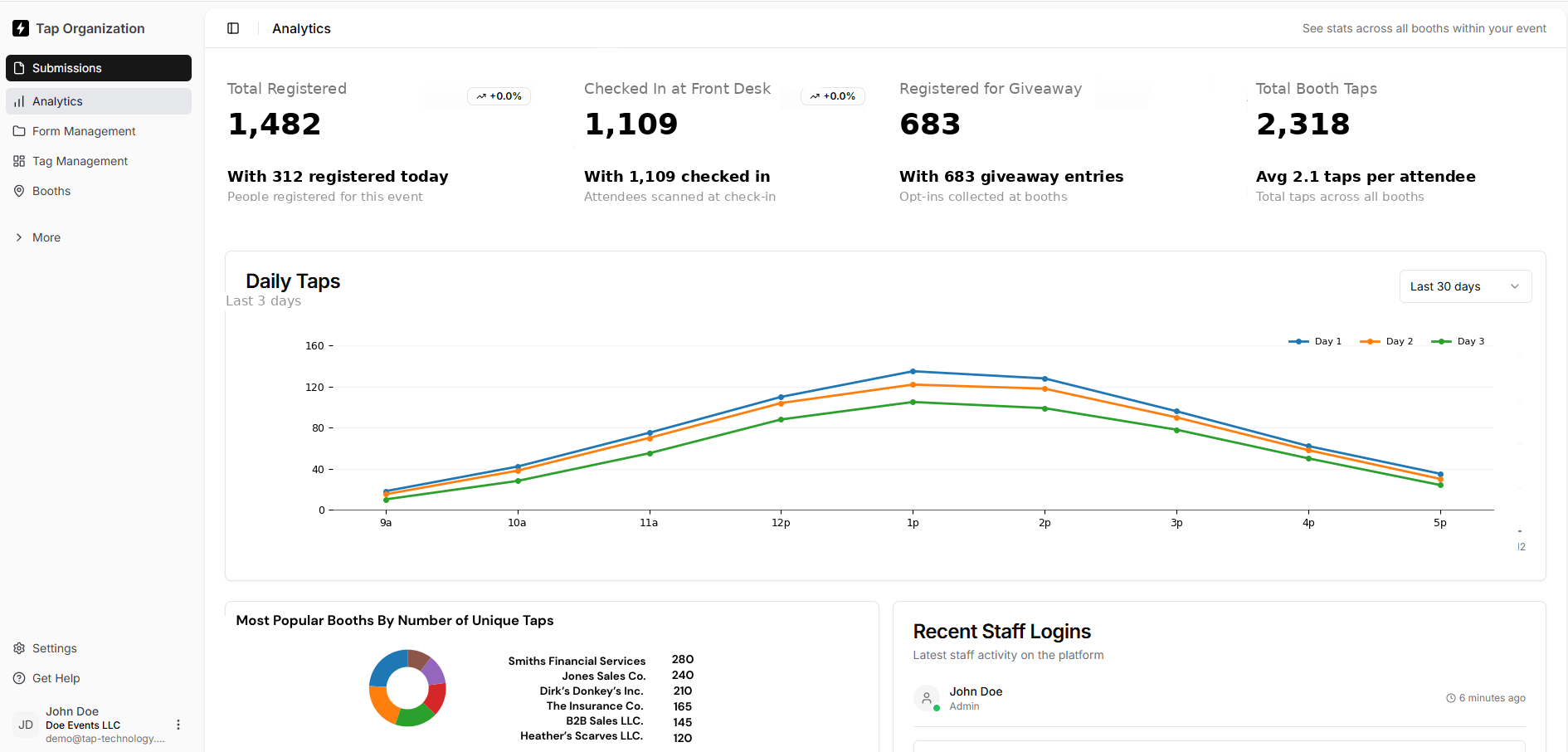

Event-wide analytics dashboard

See booth traffic, engagement patterns, and which exhibitors are drawing crowds—in real time.

Prove event ROI

Real data to justify sponsor pricing and demonstrate measurable value to stakeholders.

One standardized system

One platform for all exhibitors. No more fragmented tools or missing data.

Happier attendees

Faster experience means more booths visited and more networking value for everyone.

For Your Exhibitors

Give your exhibitors a better lead capture experience

Custom booth fields

Each exhibitor can define exactly what info they need—or use the defaults you set.

Clean CRM exports

No more transcribing business cards or deciphering paper forms. Data exports to any CRM.

Instant access

Leads appear in their dashboard the moment they're captured. Follow up while it's fresh.

Reusable attendee profiles

Returning attendees submit even faster. Every tap after the first takes seconds.

Why Tap

Why event organizers choose Tap

No app download required

Works instantly via App Clip on iPhone.* Attendees get an app-like experience without the friction of downloading anything.

Privacy by design

Consent-based sharing every time. Attendees control what information they share with each booth.

Reusable profiles

Faster taps, cleaner data, less drop-off. Profiles persist across events, making repeat attendees even more efficient.

Flexible platform

Limitless custom fields, works for career fairs, trade shows, conferences—any event with exhibitors.

* App Clip available on iPhone 7 and later running iOS 14+. QR codes available as fallback for all devices.

FAQ

Common questions

Ready to modernize your events?

See how Tap can transform lead capture for your next event.